Source: Enel’s commitment to coal phase-out, p.109 of Sustainability Report 2023 . Available at: sustainability-report_2023.pdf

In June 2023, a group of investors, members of the Italian Sustainable Investment Forum (ItaSIF – Forum per la Finanza Sostenibile*) and a select group of Climate Action 100+** investor signatories, developed three expectations for Enel.

- Disclose the coal phase out strategy (high level principles);

- Disclose a road map that defines milestones plant by plant;

- Disclose the context and constraints applying to coal plants in Italy and Spain.

As a result of the engagement with this group of investors led by Generali AM and Kairos Partners, Enel has published a dedicated coal section in its 2023 Sustainability Report, including:

- The reiteration to phase out coal by 2027;

- The previous trajectory of coal capacity since 2015;

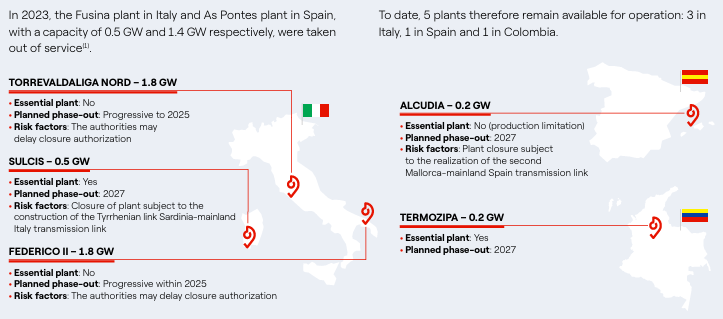

- A detailed roadmap for each of the remaining coal plants;

- A detailed process which ENEL follows to close a plant.

All parties acknowledged the progress Enel has made in disclosing its Net Zero strategy in general, including a deep dive into its plan to phase out coal generation.

Stefano De Angelis – Chief Financial Officer at Enel:

“We deem the engagement with Forum per la Finanza Sostenibile and Climate Action 100+ as best practice of how investors and industry players can share a mutually fair and effective disclosure framework.

With the 2025-27 Strategic Plan, Enel has confirmed the commitment to achieve a financially sustainable Net Zero by 2040 and the target to close all its coal plants by 2027. The achievement of such a target will of course be subject to a positive outcome granted by the local regulatory authorities in terms of authorizations, sustainable financial conditions on both the dismantling activities and reconversion of the facilities. For their reconversion, Enel will evaluate new energy projects, in integration with non-energy projects developed by third parties.”

François Humbert, Lead Engagement Manager at Generali Asset Management:

“We commend Enel for the disclosure related to the phase-out of coal generation. This disclosure is a significant achievement of our engagement with Enel, which we want to thank for its openness and responsiveness throughout our dialogue. We look forward to continuing our dialogue with Enel on the implementation of the plan in compliance with local regulatory authorities’ input. We also thank Climate Action 100+, IIGCC and ITASIFITASIF for their support.”

Oriana Bastianelli, Head of ESG at Kairos Partners:

“We appreciate the effort made by Enel toward the “last mile” of the coal dismantling process, initiated a long time ago. The achievement comes also thanks to the engagement of the national transmission system operator within the framework of the Italian decarbonization policy.”

Arianna Lovera, Research Manager at ItaSIF – Forum per la Finanza Sostenibile:

“We have been happy to host this collaboration within the working group on engagement involving our members. This is clearly a best practice which we would like to leverage on in the future.”

Peter Taylor, Corporate Programme Director at IIGCC, founding network of Climate Action 100+ and coordinator of Climate Action 100+ in Europe:

“This is an example of constructive and effective engagement with clear outcomes between investors and company. It is important to recognise that positive corporate engagement requires time, effort and a willingness to listen by all parties. While not all engagement outcomes are made public, doing so serves as an important reminder about the value and effectiveness of corporate engagement to help investors manage climate-related material financial risks and opportunities in support of their long-term financial goals.”

*The Italian Sustainable Investment Forum (ItaSIF) is a multi-stakeholder, non-profit association founded in 2001. Members are not only financial operators, but also civil society organizations involved in the environmental and social impact of finance. ItaSIF has more than 170 members among asset managers, banks, insurance companies, pension funds, NGOs, and other organizations.

**Climate Action 100+ is an investor-led initiative, which aims to ensure the world’s largest corporate greenhouse gas emitters take action on climate change.

Investors part of the investor group

| Investor | Capacity | Network |

| Generali Asset Management | Founder and Co-Leader in ItaSIF and Co-leader in Climate Action 100+ | ItaSIF and Climate Action 100+ |

| Kairos Partners | Founder and Co-leader in ItaSIF | ItaSIF |

| ANIMA SGR | Supporter | ItaSIF |

| Camperio SIM | Supporter | ItaSIF |

Fideuram Asset Management

| Supporter | ItaSIF |

| Fideuram Asset Management Ireland. | Supporter | ItaSIF |

| Fondo Pegaso | Supporter | ItaSIF |

| Fondo Poste | Supporter | ItaSIF |

| IMPact SGR | Supporter | ItaSIF |

| Inarcassa | Supporter | ItaSIF and Climate Action 100+ |

| Mediolanum Gestione Fondi | Supporter | ItaSIF |