Frequently Asked Questions

Last updated March 2024. This FAQ is provided for information only. It should not be construed as advice, nor relied upon.

About

Launched in 2017, Climate Action 100+ is the world’s largest investor-led initiative focused on engaging 168 of the largest corporate greenhouse gas emitters to reduce emissions, improve governance, and strengthen climate-related financial disclosures. Coordinated by five member networks, Climate Action 100+ supports signatories in their corporate stewardship activities to create long-term shareholder value. In June 2023, Climate Action 100+ launched its phase two strategy. Running until 2030, this phase expands the ways investors can participate and calls on companies to implement climate transition action plans, detailing how they will achieve the core goals of the initiative.

Climate change and the decarbonization of the global economy are systemic and complex challenges that are best addressed through a common response and collaborative action between key stakeholders globally. From an investor’s perspective, climate risks are financial risks. Alignment around high-level goals – as set out by Climate Action 100+ – is an impactful and effective way for investors to send signals to companies and other stakeholders to help manage these risks. This is done to preserve long-term shareholder value for their clients and beneficiaries, in line with their fiduciary duties. Indeed, investors have stated that Climate Action 100+ actively helps them in fulfilling their fiduciary duties.

Climate Action 100+’s core goals make for more effective engagement (whether collaboratively or individually) as they provide clarity over investors’ expectations of companies. Similarly, collaborative engagement via Climate Action 100+ is also more efficient and constructive from a company perspective. The initiative provides signatories with expert networks, data-driven frameworks, and engagement cases that expand investors’ capacity for research. This supports peer exchange, sharing of expertise, learnings and best practice for investors – while expecting investors to act independently and comply with relevant information exchange laws.

Building on its success of its first phase, Climate Action 100+ has expanded the ways investors can meaningfully participate in engagements, including via thematic and sector engagements. Investors choosing to participate in the new thematic and sector workstreams can work with companies, policymakers and/or other stakeholders to overcome barriers to transition – for example, technological advancements, such as those on green steel and cement or sustainable aviation fuels, and topics, such as addressing methane leakage. All Climate Action 100+ engagement opportunities are intended to further support investors in understanding and managing climate risks and opportunities.

It is a foundational principle of the initiative that investors are independent fiduciaries responsible for their own investment and voting decisions and must always act completely independently to set their own strategies, policies and practices based on their own best interests. The use of engagement tools and tactics, including the scope of participation in Climate Action 100+ engagements are at the discretion of each individual investor. How investors choose to manage climate risk and set their individual strategies, policies and practices and their Climate Action 100+ related activity is for them to decide.

Over the last seven years, investors in Climate Action 100+ have achieved remarkable progress in driving the business transition to a net zero emissions economy. They have set the industry standard for corporate climate ambition and action – by sponsoring development of the first-of-its kind Net Zero Company Benchmark. The most recent benchmark found that 77% of focus companies have pledged to achieve net zero emissions by 2050 or earlier, covering at least Scope 1 and 2 emissions. Additionally, 93% of focus companies have implemented board committee oversight of climate change risks and opportunities, while 90% of focus companies have explicitly committed to aligning their disclosures with the Task Force on Climate-related Financial Disclosures’ (TCFD) recommendations.

The initiative is open to asset owners, asset managers and engagement service providers formally representing assets. Asset managers and engagement service providers formally representing assets can only join as investor participants. Asset owners can join as investor supporters or investor participants. Investor participants are responsible for participating directly in Climate Action 100+ engagements. They can join as:

Lead company investors: The main role of lead company investors is to drive the Climate Action 100+ engagement agenda with their focus companies.

Contributing company investors: The main role of contributing investors is to proactively support lead company investors in their engagements.

Individual engagers: Signatories may formally engage focus companies on the goals of Climate Action 100+ on their own and without participating in meetings that include other signatories, if they fulfil certain conditions and meet reporting requirements.

Today, signatories can also participate in thematic and sector engagement. All engagement is undertaken in line with the following disclaimer.

Investor supporters are asset owners who publicly support Climate Action 100+ as well as its goals and objectives, but do not participate directly in engagements with focus companies. However, they are encouraged to request that their investment managers or service providers with responsibility for engagement join the initiative. More information is available in the Climate Action 100+ Signatory Handbook here.

Signatories (investor supporters and investor participants) must be a member of one of the five investor networks – the Asia Investor Group on Climate Change (AIGCC), Ceres, Investor Group on Climate Change (IGCC), Institutional Investors Group on Climate Change (IIGCC) and Principles for Responsible Investment (PRI). Investor participants must also join a contributing engagement team for at least one focus company each year or engage at least one focus company as a formal individual engager. In addition to this, investor participants have the option to join a sector and/or thematic engagement group.

The work of the initiative is supported by five investor networks: the Asia Investor Group on Climate Change (AIGCC), Ceres, Investor Group on Climate Change (IGCC), Institutional Investors Group on Climate Change (IIGCC) and Principles for Responsible Investment (PRI). The networks, as cofounders of the initiative, provide secretariat support for investors, help facilitate initiative meetings, help arrange sector-level working group calls, provide technical assistance and create opportunities for engagement skills enhancement.

Investor networks do not act or speak on behalf of each other or Climate Action 100+ signatories. They also do not seek directly or indirectly, either on their own or another’s behalf, the power to act as proxy for a security holder and do not furnish or otherwise request or act on behalf of a person who furnishes or requests, a form of revocation, abstention, consent or authorization. In addition, the investor network entities do not provide investment or voting recommendations and they do not provide investment, legal, accounting or tax advice.

No. Climate Action 100+ is a voluntary initiative and investors are bound by their own policies which may be informed by their regulatory environment and agreements with clients.

Recent Departures

Climate Action 100+’s public response to these departures can be found here.

We know that the political pressure some investors are facing in certain markets is pushing investors to carefully consider how to best manage climate risks in their portfolios. However, despite the challenging backdrop in some markets, the initiative has the backing and support from hundreds of investors globally, including asset owners and managers. 60 new signatories with approximately $3 trillion in AUM have joined since the launch of phase two alone, thereby further highlighting the strong ongoing demand for investor-led climate action. Importantly, Climate Action 100+ is a voluntary initiative that investors are free to request to join or withdraw from at any time.

Climate change is real. Climate risk is financial risk. Denying these two facts is misguided and misleading.

The fundamental principle that underpins Climate Action 100+ is that climate risk is financial risk. Actively managing climate-related risk is consistent with managing any other financial risk.

Investors participating in Climate Action 100+ and engaging with companies do so to preserve long-term shareholder value for their clients and beneficiaries, in line with their fiduciary duties.

Importantly, all participating investors are independent fiduciaries responsible for their own investment and voting decisions and have agreed to always act independently in setting strategies, policies and practices and deciding whether and how to engage with focus companies based on the investor’s fiduciary duty. Each individual signatory makes their own decision regarding ongoing participation in Climate Action 100+.

Legal

No. The fundamental principle that underpins Climate Action 100+ is that climate risk is financial risk. Actively managing climate-related risk is consistent with managing any other financial risk. Investors participating in Climate Action 100+ engage with companies to manage risk and opportunity to preserve long-term shareholder value for their clients and beneficiaries, in line with their fiduciary duties. Indeed, investors have stated that Climate Action 100+ promotes their ability to fulfil their fiduciary duties. The preservation of long-term shareholder value is central to a fiduciary relationship.

Climate Action 100+ also recognises asset managers are bound by their duties as fiduciaries. The particulars of that duty can vary by jurisdiction and by context (e.g. whether retirement funds are involved), but generally, this means that asset managers must act in the best interests of their clients. The voluntary commitments made by the Climate Action 100+ signatories are subject always to the individual signatories’ obligations to comply with the fiduciary duties, with governing law in applicable jurisdictions and with mandates or policy guidelines agreed with or imposed by clients.

Across jurisdictions, it is recognised that climate risk and the transition to a net zero economy are economic factors, like interest rates and inflation, that may impact the long-term financial returns of portfolios. As an example, the UK’s Financial Markets Law Committee (FMLC) recently published a paper, commissioned by the UK government, which provides assurance on the legal position on pension fund trustees’ fiduciary duty when considering sustainability and climate change. Similarly, the PRI’s A Legal Framework for Impact sets out to clarify how regulators in 11 jurisdictions view “investing for sustainability impact” which involves the use of investment powers, stewardship and engagement with policy makers to produce assessable positive sustainability impacts.

Importantly, all participating investors are independent fiduciaries responsible for their own investment and voting decisions, and they agree to always act independently in setting strategies, policies and practices and deciding whether and how to engage with focus companies based on their own understanding of their best interests. It is also a matter for individual signatories to make their own decisions regarding ongoing participation in the initiative.

Yes. The activities and requirements of Climate Action 100+ do not violate antitrust laws and its policies that prohibit sharing competitively sensitive information. Investors engage with companies and evaluate climate risks as part of a responsible investment approach to protect and enhance value, thereby fulfilling their fiduciary duties. Antitrust laws protect competition and prohibit various practices that harm consumers. These laws do not prohibit investors or companies from working together to achieve a common goal that is not anti-competitive and that they have each independently decided is in their interest. Several regulatory clarifications, including those from the UK Competition and Markets Authority and the Japan Fair Trade Commission, have made this clear. For an in-depth analysis of this issue in the US see this paper below from the Columbia Law School Sabin Center for Climate Change Law.

Useful links:

- Columbia Law School Sabin Center for Climate Change Law: https://ccsi.columbia.edu/sites/default/files/content/docs/Antitrust-Sustainability-Landscape-Analysis.pdf

- Japan Fair Trade Commission:

- UK Competition Markets and Authority: https://assets.publishing.service.gov.uk/media/6526b81b244f8e000d8e742c/Green_agreements_guidance_.pdf

No. Signatories may not claim to represent other signatories or make statements referencing other signatories without their express consent. Any decision by signatories to take action with respect to acquiring, holding, disposing and/or voting of securities shall be at their sole discretion and made in their individual capacities and not on behalf of Climate Action 100+, its investor networks or their other signatories or members. Signatories must avoid coordination of strategic behavior between competitors that impacts or is likely to impact competition.

The PRI has also produced Acting in Concert guides for UK, Germany, South Africa. See here https://www.unpri.org/stewardship/addressing-system-barriers/6270.article

See the initiative’s full disclaimer here for more information.

Phase Two

Climate Action 100+ has been consistent in its fundamental purpose of ensuring the world’s largest corporate greenhouse gas emitters take necessary action on climate change. The initiative has always been action-oriented – as the name Climate Action 100+ would suggest – and about more than disclosure. In this respect, nothing has changed.

Phase two, which launched in June 2023 following a thorough consultation with investor signatories, saw the initiative renew its three goals, evolve the Net Zero Company Benchmark, enhance the ways in which investors can participate, and make marginal updates to the company focus list.

The specific updates to the three core expectations of companies are outlined in bold below:

Phase 1 Goals:

Climate Action 100+ signatories have agreed on a common engagement agenda that seeks commitments from the boards and senior management of focus companies to:

1. Implement a strong governance framework which clearly articulates the board’s accountability and oversight of climate risk;

2. Take action to reduce greenhouse gas emissions across the value chain, consistent with the Paris Agreement’s goal of limiting global average temperature increase to well below 2°C above pre-industrial levels, aiming for 1.5°C. Notably, this implies the need to move towards net-zero emissions by 2050 or sooner; and

3. Provide enhanced corporate disclosure in line with the final recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and sector-specific Global Investor Coalition on Climate Change (GIC) Investor Expectations on Climate Change guidelines (when applicable), to enable investors to assess the robustness of companies’ business plans against a range of climate scenarios, including well below 2°C, and improve investment decision-making.

Phase 2 Goals:

1. Implement a strong governance framework which clearly articulates the board’s accountability and oversight of climate change risk;

2. Take action to reduce greenhouse gas emissions across the value chain, including engagement with stakeholders such as policymakers and other actors to address the sectoral barriers to transition. This should be consistent with the Paris Agreement’s goal of limiting global average temperature increase to well below 2°C above pre-industrial levels, aiming for 1.5°C. Notably, this implies the need to move towards net-zero emissions by 2050 or sooner; and

3. Provide enhanced corporate disclosure and implement transition plans to deliver on robust targets. This should be in line with the final recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and other relevant sector and regional guidance, to enable investors to assess the robustness of companies’ business plans and improve investment decision-making.

Importantly, the updated third goal for companies to implement transition plans in phase two is logical and naturally builds on what came before – indeed, many signatories have already been asking for these for some time.

Specifically, in phase one, investors requested that companies provide enhanced disclosures to enable them to assess the robustness of companies’ business plans against a range of climate scenarios. This was intended to improve investment decision making. Having disclosed the risks, it is natural that in phase two investors ask companies to address them, i.e. to implement transition plans.

A summary of the updates for phase two can be viewed here.

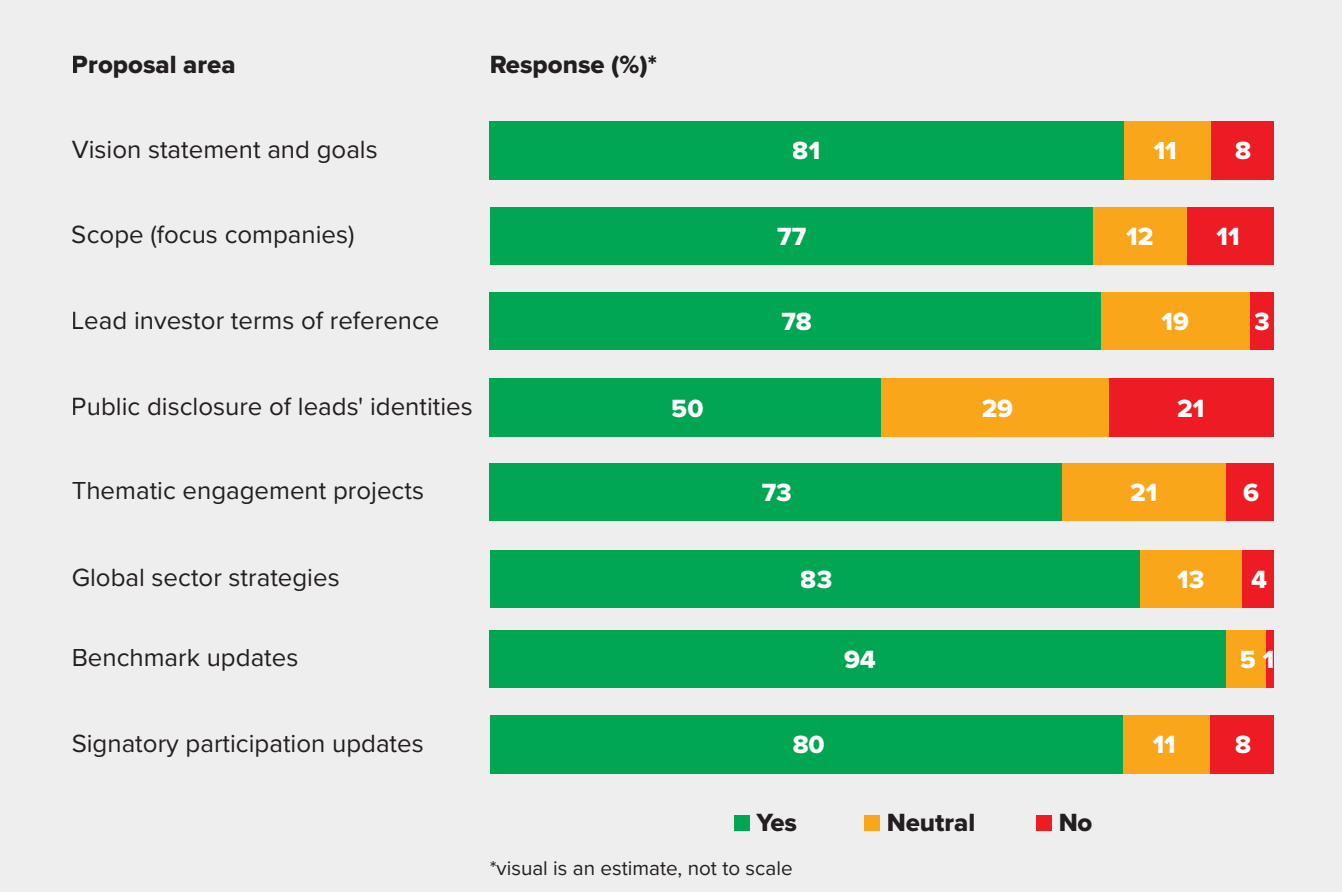

Phase two of Climate Action 100+ launched in June 2023 following an extensive and thorough consultation with investor signatories. This included roundtable events in Africa, Asia, Australia North America, Europe and Latin America. The strategy was also previewed for investors and other stakeholders at PRI in Person in December 2022. This table sets out the responses to quantitative questions in the survey. It demonstrates support for the overall proposed direction for Phase 2, although please note that many investors provided more nuanced qualitative comments which are not represented here. This table is also available on Page 26 here.

No. We believe that the year-ahead engagement plan is best kept confidential in order to most effectively facilitate investors’ work.